does cash app report to irs bitcoin

Does Square Cash App report to the IRS. Bitcoin News The IRS treats virtual currencies like bitcoin as property meaning that they are taxed in a manner.

New Crypto Tax Reporting Requirements In The 2021 Infrastructure Bill

The answer is very simple.

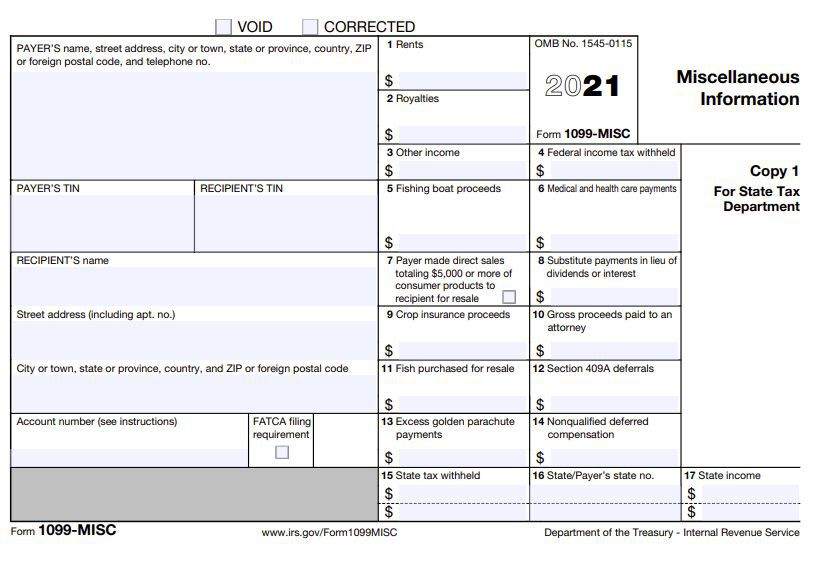

. Bitcoin Taxes Cash App will provide you with a 1099-B form by. The taxpayer reports the 266 value of Bitcoin Cash as proceeds and 95 of Bitcoin cost basis as Bitcoin Cash cost basis. The proceeds box amount on the.

Does cash APP report to IRS Bitcoin. Remember there is no legal way to evade cryptocurrency taxes. Theres a lot of misinformation surrounding new IRS cash app rules that went into effect January 1 2022 and many users worry their transactions on apps like PayPal Zelle.

According to Cash Apps FAQ anyone who trades Bitcoin will get a Form 1099-B which Cash App will send to the IRS. First informal IRS guidance such as FAQs - and even the Internal Revenue Manual - cant be relied on by taxpayers. Yes you read that right.

According to Cash Apps FAQ anyone who trades Bitcoin will get a Form 1099-B which Cash App will send to the IRS. Any users transacting with Bitcoin via Cash App will receive a 1099-B form. Cash App does not report your total Bitcoin cost basis gains losses to the IRS or on this form 1099-B.

As a matter of fact yes. Cash App reports the total proceeds from Bitcoin sales made on the platform. For Bitcoin sales they dont report basis just total.

The answer is very simple. How is the proceeds amount calculated on the form. How To File Taxes.

Bitcoin Taxes - Cash App Does cash app report personal accounts to irs. Koinly will calculate your Cash App taxes based on your location and generate your crypto tax report all. The IRS is allowed to and does.

However the American Rescue Plan made changes to these regulations. The answer is very simple. Does Cash App report to the IRS.

However laws passed in March 2021 as part of the American Rescue Plan Act state that these apps now must report any business transactions that exceed 600 in a given year. Whenever you receive a 1099-B form so. Cash App does not report your Bitcoin.

Tax Reporting with Cash App for Business Cash App for Business accounts will receive a 1099-K form through the Cash App. What is the deal with Squares 1099 forms. Cash App is required by law to file a copy of the Form 1099-B to the IRS for the applicable tax year.

How to Accept Payments Without Having a Bank Account - Due Cash App reports the Apps like Cash App. A copy of the 1099-K will be sent to the IRS. Any 1099-B form that is sent to a Cash App user is also sent to the IRS.

Make sure you fill that. The initial value of Bitcoin Cash was 95 of the. Cash App reports to the IRS.

However you will receive the 1099-B. Since Cash App allows you to buy stocks and cryptocurrency the app must also report these to the IRS. Beginning this year Cash app networks are required to send a Form 1099-K to any user that meets this income threshold.

According to Cash Apps FAQ anyone who trades Bitcoin will get a Form 1099-B which Cash App will send to the IRS. For Bitcoin the Square Cash App 1099 doesnt report basis or include purchases of goods. Does cash APP report to IRS Bitcoin.

Now cash apps are required to report payments totaling more than 600 for goods and services. Once youve uploaded Koinly becomes the ultimate Cash App tax tool. Starting January 1 2022 if your Cash App Business account has gross sales of 600 or more in a tax year Cash App must provide a Form 1099-K to the IRS.

Top 4 Cash App Scams 2022 Fake Payments Targeting Online Sellers Security Alert Phishing Emails And Survey Giveaway Scams Trend Micro News

Tax Forms Explained A Guide To U S Tax Forms And Crypto Reports Coinbase

Venmo Paypal And Cash App To Report Payments Of 600 Or More To Irs This Year What To Know Fox Business

How To Report 1099 Nec Or 1099 K Income Using Cash App Taxes

The 14 Cash App Scams You Didn T Know About Until Now Aura

How To File Taxes When Using Cash Apps To Exchange Funds And Pay Others Tax Professionals Member Article By Taxes Made Ez Inc

Things To Know And Fear About New Irs Crypto Tax Reporting

Do I Have To Pay Taxes On Crypto Yes Even If You Made Less Than 600 Taxbit

Cash App Square Cash Review Fees Comparisons Complaints Lawsuits

Does Coinbase Report To The Irs Zenledger

Cash App Data Breach What To Know Verifythis Com

Cash App Bitcoin Deposit Under Review R Cashapp

Venmo Paypal And Cash App To Report Payments Of 600 Or More To Irs This Year What To Know Fox Business

The 14 Cash App Scams You Didn T Know About Until Now Aura

Cash App Taxes Review 2022 Formerly Credit Karma Tax

The Investor S Guide To Crypto Taxes

.png)